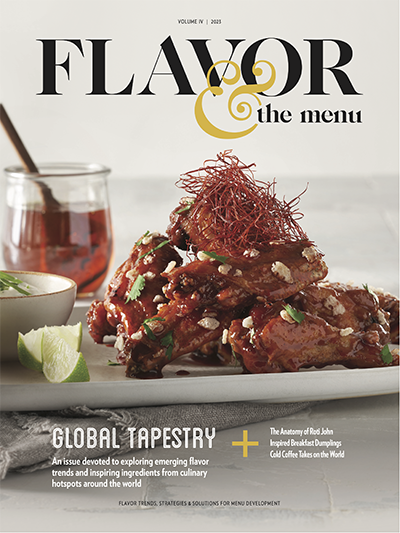

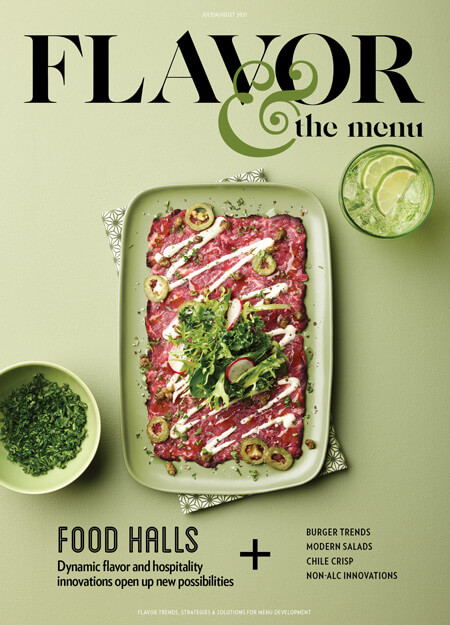

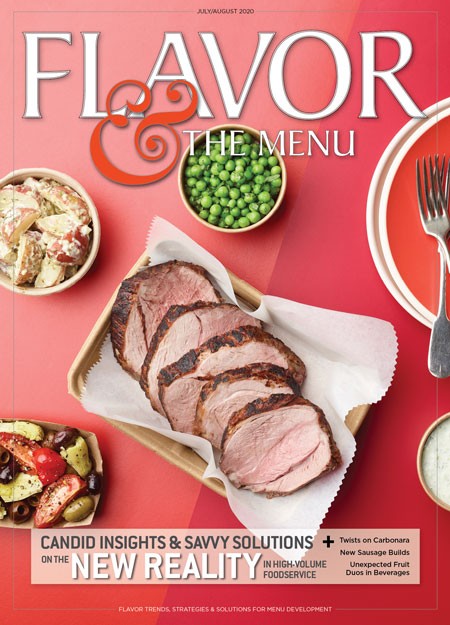

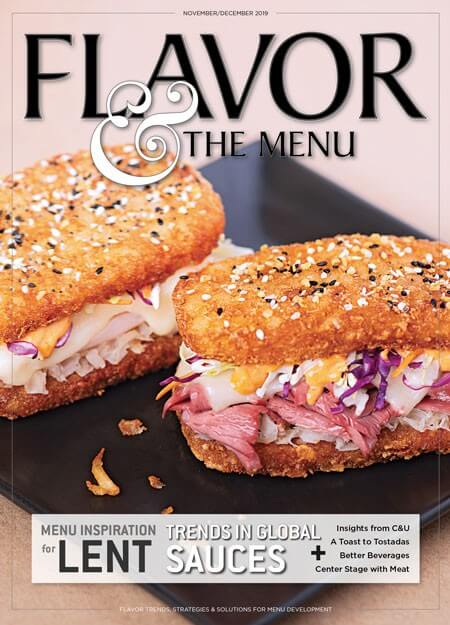

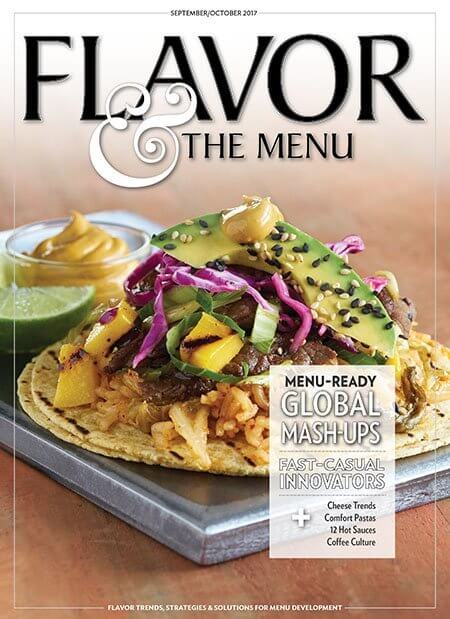

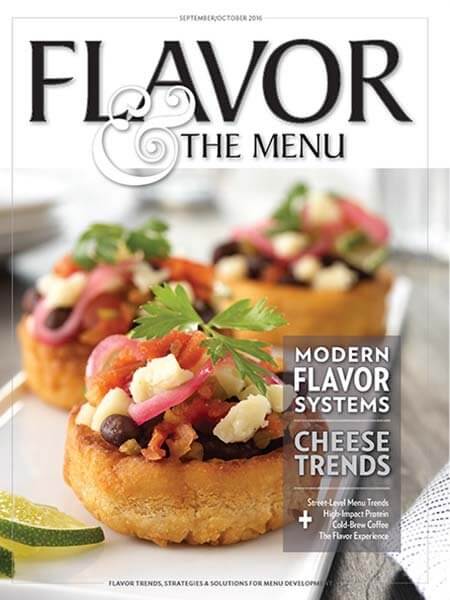

Current Issue

DO YOU RECEIVE OUR MAGAZINE?

A print subscription to Flavor & The Menu is FREE for foodservice operators (chefs, menu developers, marketing/purchasing, food & beverage teams, etc.). Click here to sign up or manage your print subscription.